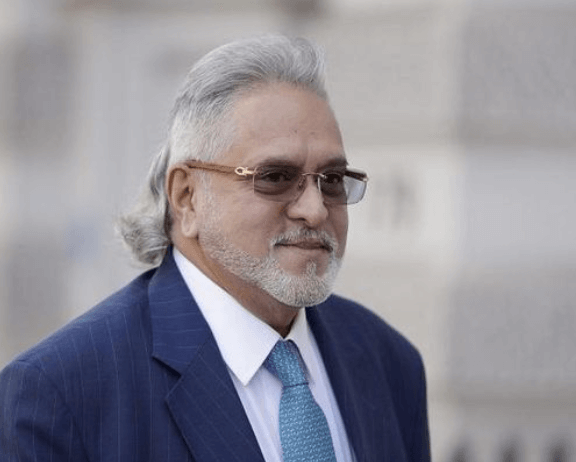

Vijay Mallya Net Worth: Business Tycoon’s Financial Story

Vijay Mallya’s financial trajectory is a striking illustration of the complexities that accompany entrepreneurial ambition. Once celebrated as a formidable force in the beverage and airline industries, Mallya’s financial empire has faced significant turbulence due to a combination of overreach and subsequent legal challenges. His narrative raises critical questions about the dynamics of corporate governance and accountability in high-stakes business environments. As we explore the nuances of Mallya’s net worth and its implications, it becomes essential to consider not just the figures, but the broader lessons that emerge from his rise and fall.

Early Life and Education

Vijay Mallya was born on December 18, 1955, in Kolkata, India, into a well-established family that laid the foundation for his future endeavors in business and entrepreneurship.

His family background provided him with crucial networking opportunities, while his educational achievements, including a degree in commerce from St. Xavier’s College, equipped him with essential skills.

This combination fostered a mindset geared towards financial independence and innovative pursuits.

See also: Pusha T Net Worth: The Rapper’s Wealth

Rise to Prominence

Building on a solid educational foundation, Mallya’s entrepreneurial journey gained momentum in the 1980s when he took over his family’s business, United Breweries Group, and began to expand its operations into a diverse range of sectors.

His innovative business strategies focused on market expansion, allowing the company to thrive.

This strategic approach positioned him as a formidable player in India’s burgeoning beverage industry.

Kingfisher Airlines Launch

The launch of Kingfisher Airlines in 2005 marked a significant expansion of Mallya’s business empire, introducing a new era of luxury air travel in India.

His launch strategy focused on redefining customer experience within the airline industry, combining premium services with innovative marketing.

This bold move aimed to capture a lucrative market segment, ultimately enhancing Mallya’s reputation as a visionary entrepreneur.

Ventures in Beverage Industry

Vijay Mallya’s ventures in the beverage industry have significantly contributed to his net worth, particularly through the success of Kingfisher Beer.

His strategic acquisition of United Breweries has further solidified his position in the market, enabling the brand to expand its reach and influence.

Analyzing these ventures reveals the complexities of Mallya’s business acumen and the impact of his decisions on the beverage sector.

Kingfisher Beer Success

Success in the beverage industry has been significantly marked by Kingfisher Beer, a brand that not only epitomizes the essence of Indian brewing but also reflects Vijay Mallya’s strategic vision and entrepreneurial spirit.

The brand’s journey includes innovative beer marketing strategies, which have helped it carve out a niche in a competitive market.

Additionally, robust brand loyalty and recognition have played a crucial role in its sustained success.

Diversified product offerings further enhance its appeal, catering to a wide range of consumer preferences.

United Breweries Acquisition Strategy

Mallya’s strategic acquisitions within the beverage sector significantly shaped the trajectory of United Breweries and enhanced its market positioning.

His acquisition strategy focused on consolidating brands and diversifying the product portfolio, facilitating market expansion.

Financial Decline and Legal Issues

Vijay Mallya’s financial decline can be attributed to a significant accumulation of debt, primarily stemming from his airline venture, Kingfisher Airlines.

This mounting financial crisis has led to various legal troubles, including charges of fraud and money laundering, which have further complicated his financial standing.

An overview of these issues reveals the intricate relationship between Mallya’s business missteps and the ensuing legal ramifications that have dramatically impacted his net worth.

Debt Accumulation Crisis

As financial mismanagement and aggressive expansion strategies took their toll, a significant debt accumulation crisis began to engulf Mallya’s business empire, leading to severe legal ramifications.

This crisis highlighted the failures in his debt management and financial strategy, resulting in unsustainable borrowing practices, deteriorating cash flow, and erosion of investor confidence.

Such factors accelerated the decline of Mallya’s once-thriving business ventures.

Legal Troubles Overview

The convergence of financial mismanagement and mounting debt culminated in a series of legal troubles for Mallya, significantly impacting his business operations and reputation.

These legal battles, marked by allegations of fraud and default, led to severe financial repercussions, including asset freezes and extradition requests.

Mallya’s once-thriving enterprises now grapple with the fallout, reflecting the consequences of his earlier decisions.

Current Net Worth Estimates

Current estimates of Vijay Mallya’s net worth vary significantly, primarily due to his ongoing legal battles and the liquidation of his business assets. Financial fluctuations have further complicated assessments of his current assets.

Key factors influencing his net worth include:

- Ongoing legal disputes

- Asset liquidation processes

- Market perception of his business ventures

These elements create a complex financial landscape for the tycoon.

Impact on Indian Business Landscape

Vijay Mallya’s financial turmoil and the subsequent fallout have left a significant mark on the Indian business landscape, influencing investor confidence and regulatory scrutiny across various sectors.

The business impact of his case has prompted a reevaluation of corporate governance, while his economic influence extends to heightened awareness regarding financial accountability, ultimately shaping the future of entrepreneurship in India.

Legacy and Future Prospects

Examining Mallya’s legacy reveals a complex interplay of entrepreneurial ambition and the consequences of financial mismanagement, which continue to influence perceptions of corporate ethics in India.

Mallya’s story exemplifies the need for robust financial oversight to foster a healthier business environment.

- Legacy impact on business governance

- Future investments shaped by regulatory scrutiny

- Ongoing discussions around corporate accountability

Conclusion

The financial saga of Vijay Mallya serves as a poignant reminder of the precarious nature of wealth and ambition.

Once celebrated as a visionary leader, the rapid decline underscores the critical need for robust financial governance and accountability within the corporate sector.

As the dust settles on Mallya’s legacy, the echoes of his rise and fall linger, offering invaluable lessons for future entrepreneurs navigating the treacherous waters of business, where success can swiftly turn to ruin.